Renters Insurance in and around Owatonna

Your renters insurance search is over, Owatonna

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It may feel like a lot to think through family events, managing your side business, work, as well as coverage options and providers for renters insurance. State Farm offers straightforward assistance and remarkable coverage for your clothing, musical instruments and appliances in your rented townhome. When the unexpected happens, State Farm can help.

Your renters insurance search is over, Owatonna

Renters insurance can help protect your belongings

Why Renters In Owatonna Choose State Farm

Renters insurance may seem like the least of your concerns, and you're wondering if having it is actually beneficial. But take a moment to think about how much it would cost to replace all the personal property in your rented space. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your belongings.

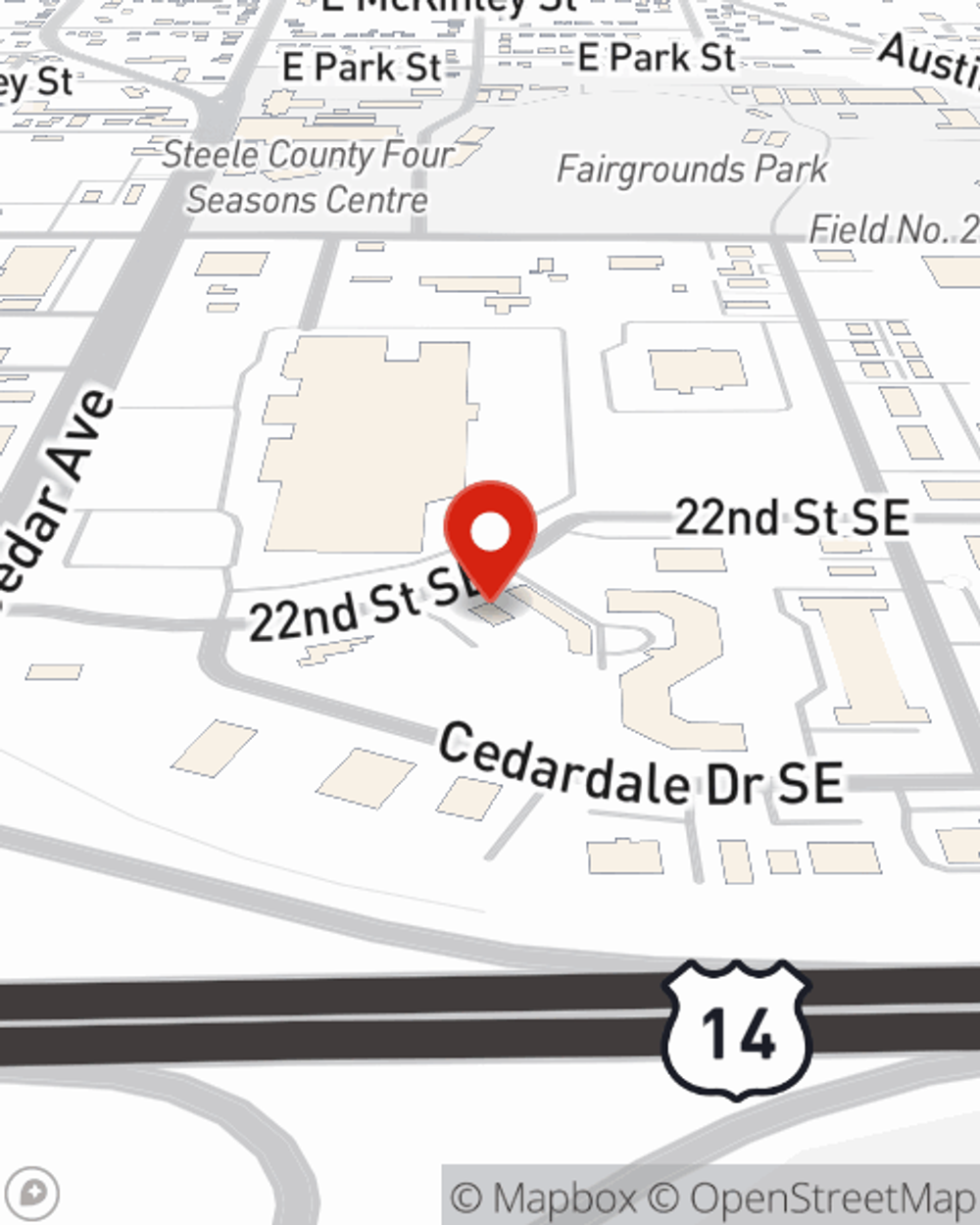

If you're looking for a reliable provider that can help you protect your belongings and save, get in touch with State Farm agent Steve Carroll today.

Have More Questions About Renters Insurance?

Call Steve at (507) 455-1660 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Steve Carroll

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.